45 how to find the coupon rate of a bond

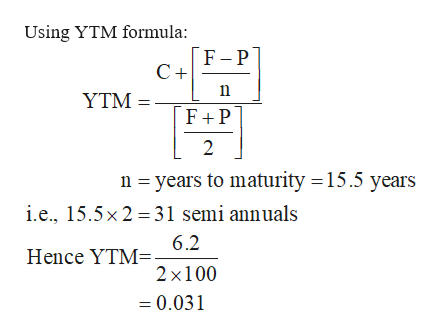

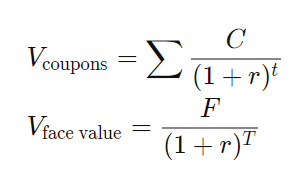

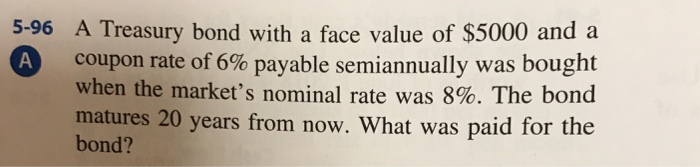

T2023-S$ Temasek Bond Coupon Rate: Fixed rate of 2.70% per year, payable every six months. Tenor: 5 years. Issue Ratings: Aaa by Moody's and AAA ... A bond's YTM is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond price, as follows: Bond's present value ... › bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

How to find the coupon rate of a bond

Municipal Bonds Market Yields | FMSbonds.com Municipal Market Yields. The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 05/02/2022. › what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis. Compound Interest Formula - Overview, How To Calculate, Example The compound interest formula [1] is as follows: Where: T = Total accrued, including interest. PA = Principal amount. roi = The annual rate of interest for the amount borrowed or deposited. t = The number of times the interest compounds yearly. y = The number of years the principal amount has been borrowed or deposited.

How to find the coupon rate of a bond. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... What Are Corporate Bonds? What You Need To Know | GOBankingRates The interest rate, sometimes called the coupon rate, tells you how much interest you will earn on the bond. Interest on corporate bonds is usually paid twice per year, but the interest rate is expressed in annual terms. If you purchase a bond with a par value of $1,000 and a coupon rate of 10%, you will get $100 in interest each year, in two ... Amortised Cost and Effective Interest Rate (IFRS 9) Transaction price (incl. coupon accrued to date): $900 Transaction fee: $10 Coupon: 5%, that is $50 (calculated on face value, fixed and paid annually on 31 December) Acquisition date: 20X1-05-01 Redemption date: 20X5-12-31 How To Check Or Calculate The Value Of Savings Bonds - Bankrate The value of a paper savings bond can be checked by using the savings bond calculator on the TreasuryDirect website and entering this information found on bond: Issue date. Bond series ...

EGP T-Bonds EGP T-Bonds Zero Coupon; Deposits (OMO) Fixed Rate Deposits; Variable Rate Deposits; Corridor Linked Deposits; Repo. Fixed Rate Repo; Variable Rate Repo; FX Auction. Regular FX - Auction; ... EGP Treasury Coupon Bonds Auctions According to the Primary Dealers System. Tenor (Years) 3: 7: Auction date: 06/06/2022: 06/06/2022: Issue date: 07/06/2022: Bonds - MunicipalBonds.com What are municipal bonds? The Key Benefit of Municipal Bonds: Tax-Free Interest; The 5 Basic Elements of Bond Investing; Two Types of Bonds: General Obligation vs. Revenue Bonds; Risks of Bond Investing; Understanding Bond Ratings; The Safety of Municipal Bonds; Default Rates of Municipal Bonds; Taxable-Equivalent Yield; Tax-Exemption from ... U.S. Treasury Bond Overview - CME Group US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. ... U.S. Treasury Bond Yield Curve Analytics ... volatility, auctions, coupon issuance projections, and more. STIR Analytics. View ... LiveLive Market Watch - Bonds Trade In Capital Market, NSE India The bonds are traded & settled on Dirty Price i.e. including accrued interest, if any. YTM computation is based on the Corporate Action dates available with the Exchange. Download the example for understanding of yield calculation

www2.asx.com.au › bond-derivativesBond derivatives - Australian Securities Exchange For each bond in the bond basket, ASX will take the best bid and best offer available in the market by reference to live market prices taken from bond trading venues as determined by the Exchange. Average of the best bid and best offer for each bond will be calculated at 9:00am, 9:45am, 10:30am and 11:15am. The Ultimate Guide to Dividend Stocks | Investing | US News Dividend stocks have a role to play in any portfolio, no matter the investor's age or financial circumstances. The reason: compounding. When the dividends these stocks pay are reinvested, an ... Calculating U.S. Treasury Pricing - CME Group So our bid-side quote converted from 1/32 to a decimal would be: 99-032 (1/32s) = 99.1015625, or 99.1015625 percent of par. The offer-side price would convert to 99-03+ = 99.109375. If you were to view a U.S. Treasury futures price quotation you might encounter something like this: TNM7 134-010/134-015. United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.248% yield.. 10 Years vs 2 Years bond spread is 47 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022).. The United Kingdom credit rating is AA, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 10.79 and implied probability of default is 0.18%.

DGAP-News: PNE AG: Subscription period for the new bond 2022/2027 ... - Coupon range for pricing from 4.500 to 5.250% - Improving the financing structure and financing further growth . The final interest rate and total nominal amount of the new 2022/2027 bonds are ...

STARBUCKS CORP.DL-NOTES 2016(16/26) Bond - Insider The Starbucks Corp.-Bond has a maturity date of 6/15/2026 and offers a coupon of 2.4500%. The payment of the coupon will take place 2.0 times per biannual on the 15.12.. At the current price of 95 ...

Zambia Government Bonds - Yields Curve The Zambia 10Y Government Bond has a 25.760% yield. Central Bank Rate is 9.00% (last modification in February 2022). The Zambia credit rating is SD, according to Standard & Poor's agency. Created with Highcharts 10.1.0. Residual Maturity Zambia Yield Curve - 16 May 2022 Zambia Government Bonds Zambia (16 May 2022) 1M ago 6M ago 10Y 24.75% 25% ...

COCA-COLA CO., THEDL-NOTES 2017(17/27) Bond - Insider The The Coca-Cola Co.-Bond has a maturity date of 5/25/2027 and offers a coupon of 2.9000%. The payment of the coupon will take place 2.0 times per biannual on the 25.11..

United States Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. United States Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

Learn How I Bonds Work - The Balance Paper bonds are sold in multiples of $50, $100, $200, $500, or $1,000. Electronic bonds can be purchased in any amount from $25 to $10,000, down to the penny. 1. Series I bonds earn interest starting on the first day of each month. That interest is compounded semi-annually based upon the issue date of the specific I bond.

Bond Statistics - Monetary Authority of Singapore Bond Statistics. Get daily closing prices, historical auction data and other statistics for Singapore Government Securities (SGS) bonds. Daily SGS Prices. Historical SGS Prices and Yields - All Issues.

PRICE Function - Formula, Examples, How to Price a Bond =PRICE (settlement, maturity, rate, yld, redemption, frequency, [basis]) The PRICE function uses the following arguments: Settlement (required argument) - The bond's settlement date or the date that the coupon is purchased. The bond's settlement date should be after the issue date.

Post a Comment for "45 how to find the coupon rate of a bond"