40 price of coupon bond

Premium vs Discount Bonds: Which Should You Buy? - SmartAsset How Bond Prices Are Set. A bond is a loan that's made by the issuer. When you purchase bonds, you're allowing the issuer to use your money. ... This means the coupon rate for the bond has fallen below wherever market rates are currently. Discount bonds can be attractive to investors who want to purchase bonds at a lower price. budgeting.thenest.com › calculate-price-bondHow to Calculate the Price of a Bond With Semiannual Coupon ... Apr 24, 2019 · Concluding the example, adding the present values of each payment results in a total present value of $964.91. This means the bond's price needs to be $964.91 to achieve an equivalent return. If you can get a lower price, you'll enjoy a higher return, but if you have to pay a higher price, you're better off opting for the alternative investment.

How much am I paying for my bonds? - Fidelity Imagine buying a single $1,000 bond with a 3% coupon maturing June 1, 2032, priced at its par value of $100. Add in a $15 per bond mark-up and your yield-to-maturity drops from 3% to 2.83%. Reduce the mark-up to $1, and your yield is 2.99%. That 16-basis-point difference can add up.

Price of coupon bond

Price of a Zero coupon bond - Calculator - Finance pointers Price of a Zero coupon bond - Calculator. August 20, 2021 | 0 Comment | 9:15 pm. The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below ... › documents › excelHow to calculate bond price in Excel? - ExtendOffice Let’s say there is a annul coupon bond, by which bondholders can get a coupon every year as below screenshot shown. You can calculate the price of this annual coupon bond as follows: Select the cell you will place the calculated result at, type the formula =PV(B11,B12,(B10*B13),B10), and press the Enter key. See screenshot: xplaind.com › 606456Clean Price (Flat Price) of a Bond | Formula & Example Apr 30, 2019 · Dirty price is the present value of future coupon payments and maturity value of the bond determined using the following formula: Dirty Price = c × F × 1 − (1 + r) -n

Price of coupon bond. Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. dqydj.com › bond-convexity-calculatorBond Convexity Calculator – Estimate a Bond's Price ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. The issuer of the bond takes out a loan on the capital market and ... Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). U.S. Treasury Bond Futures Quotes - CME Group Price Quotation. Points and fractions of points with par on the basis of 100 points. Product Code. CME Globex: ... U.S. Treasury Bond Yield Curve Analytics ... volatility, auctions, coupon issuance projections, and more. STIR Analytics. View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR ... Zero Coupon Bond | Definition, Formula & Examples - Study.com Purchase a $10,000 Zero Coupon Bond from Company X that matures in 5 years. According to the latest quote, the $10,000 Zero Coupon Bond of Company X is trading at $9,110. You thus have a decision... Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

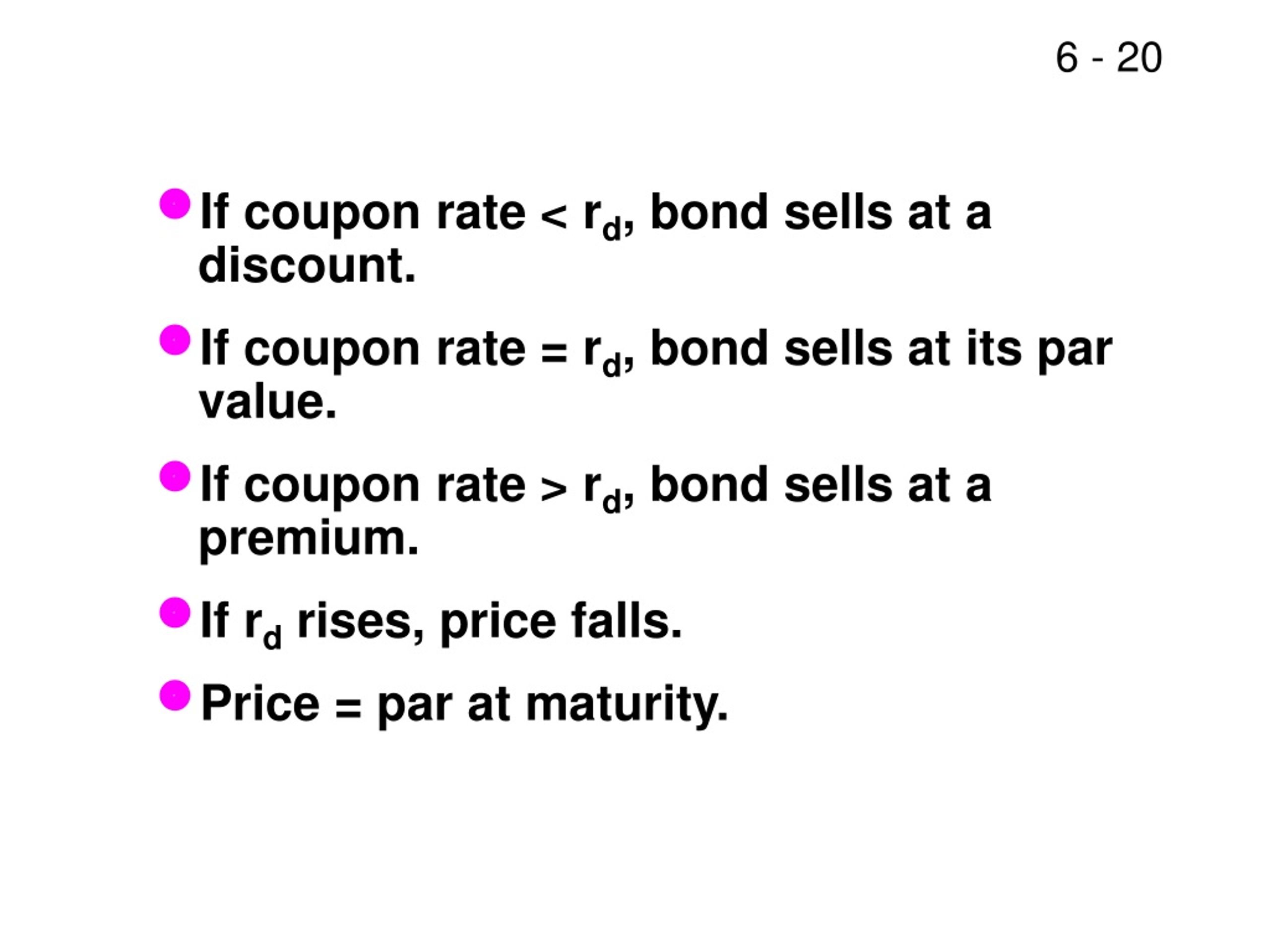

Coupon Rate Calculator | Bond Coupon For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)? Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. What Is Market Price of a Bond | Bond Prices | India Market price of a bond with a face value of ₹100, YTM of 6.085%, annual coupon rate of 7.5% paid semi-annually, term to maturity of 9 years, will be ₹110 MARKET PRICE TERMINOLOGY In the context of a market price, we often hear terms like 'par', 'discount', and 'premium'. AMAZON.COM INC.DL-NOTES 2021(21/28) Bond - Insider The Amazon.com Inc.-Bond has a maturity date of 5/12/2028 and offers a coupon of 1.6500%. The payment of the coupon will take place 2.0 times per biannual on the 12.11.. At the current price of 89 ...

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Zero Coupon Bond | Definition, Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond:

What Is Dirty Price? - thebalance.com The dirty price is calculated as follows: 1 Dirty price = Clean price + Accrued interest You'll typically see a bond price quoted as a percentage of its face value, also known as par value. 2 For example, if Corporation ABC issues bonds with a $1,000 face value that are quoted at 97, the price of the bond is $970.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

What Are Corporate Bonds? What You Need To Know | GOBankingRates Some bonds, called zero-coupon bonds, do not pay interest during the term of the bond. They are purchased for prices below par, then the par value is paid when the bond matures. The investor's return is the difference between the purchase price paid for the bond and the par value. For example, a five-year zero-coupon bond with a par value of ...

› terms › zZero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

Fitted Yield on a 7 Year Zero Coupon Bond (THREEFY7) Graph and download economic data for Fitted Yield on a 7 Year Zero Coupon Bond (THREEFY7) from 1990-01-02 to 2022-06-24 about 7-year, bonds, yield, interest rate, interest, rate, and USA.

Quant Bonds - Between Coupon Dates - BetterSolutions.com A corporate bond has a 10% coupon and a maturity date of 1 March 2020. It has a current dirty price if £118.78 The settlement date is 17 July 2014 SS - excel settlement date maturity date frequency - 2 semi-annual Day Convention / Basis Coupon Rate Coupon Days Accrued Number of Days in Period Quoted Dirty Price Accrued Interest Clean Price

Bond Pricing | Valuation | Formula | How to calculate with example | eFM Calculate the price of a bond whose face value is $1000. The coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8 The following is the summary of bond pricing:

What Is a Zero-Coupon Bond? | The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 =...

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Days Since Last Payout - Enter the number of days it has been since the bond last issued a coupon payment into this field of the bond pricing calculator. Coupon Payout Frequency - How often the bond makes a coupon payment, per year. If it only pays out at maturity try the zero coupon bond calculator, although the tool can compute the market ...

Why Are Bonds Down? The table shows the initial price of a ten-year $1,000 zero coupon bond for several different interest rates. For example, lending $905 to receive $1,000 in 10 years yields 1%. If rates are higher ...

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

Bond Coupon Interest Rate: How It Affects Price - Investopedia A $1,000 bond has a face value of $1,000. If its coupon rate is 1%, that means it pays $10 (1% of $1,000) a year. Coupon rates are largely influenced by prevailing national government-controlled...

Post a Comment for "40 price of coupon bond"