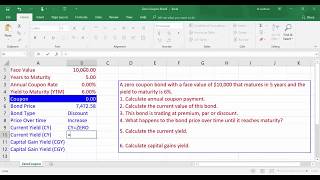

39 present value of a zero coupon bond

› financial › npv-calculatorNet Present Value Calculator - CalculateStuff.com Once we calculate the present value of each cash flow, we can simply sum them, since each cash flow is time-adjusted to the present day. Once we sum our cash flows, we get the NPV of the project. In this case, our net present value is positive, meaning that the project is a worthwhile endeavor. What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Zero Coupon Bond - Explained - The Business Professor, LLC Unlike the regular, coupon-paying bonds, a zero-coupon bond has an imputed interest rate (rather than an established interest rate). To illustrate, if a bond with a face value of $1,000 matures in 20 years with a 5.5% annual yield, can be purchased at $3,378.

Present value of a zero coupon bond

› terms › pWhat Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive...

Present value of a zero coupon bond. Zero Coupon Bond Calculator - What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 ... Zero Coupon Bonds - Financial Edge Value and YTM of Zero Coupon Bonds Bonds are valued by calculating the present value of future cash flows using an appropriate discount rate or interest rate. You can calculate the price of a bond using this formula: Price of Bond = Face value or maturity value/ (1+interest rate) years to maturity Calculating the value of a zero coupon bond Zero Coupon Bond Calculator - Nerd Counter Now the thing to understand is how this yield is calculated, so for that, and there is a particular formula in terms of economics that helps us to calculate that yield. The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods

› retirement › calculatingCalculating Present and Future Value of Annuities - Investopedia Apr 25, 2022 · Here is how to calculate the present value and future value of ordinary annuities and annuities due. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Corporate Finance. Zero Coupon Bond Value Calculator - buyupside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 . Related Calculators. Bond Convexity Calculator. Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity Bond Present Value ... How to calculate the present value of a bond — AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Zero-Coupon Bond - The Investors Book Z wants to purchase a zero-coupon bond issued by ABC & Co., with a face value of Rs. 10000. The required annual yield is 12% p.a. and it matures in five years. Find out the price which Z needs to pay at present.

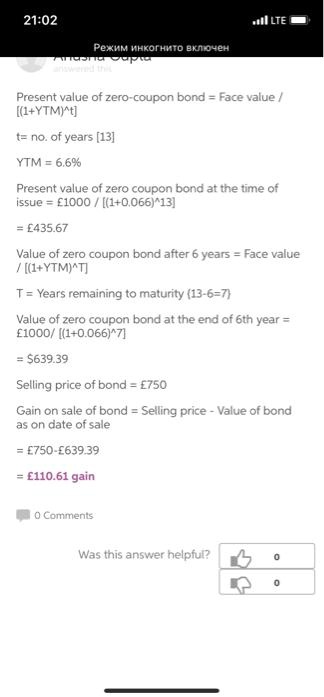

1. Calculate the present value of a $1,000 zero-coupon bond...get 5 1. Calculate the present value of a $1,000 zero-coupon bond with six years to maturity if the... 1. Calculate the present value of a $1,000 zero-coupon bond with six years to maturity if the yield to maturity is 7%. 2. A lottery claims its grand prize is $20 million, payable over 40 years at $500,000 per year. Zero Coupon Bond - Zero Coupon Bond - GitBook A zero coupon bond is a bond that doesn't pay interest/coupon but instead pays one lump sum face value at maturity. ... The present value of a defaultable zero coupon bond can be expressed as. where. s - credit spread. 1. Zero Coupon Bond Price vs Discount Factor. › calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. Solved Calculate the present value of a $1,000 zero-coupon - Chegg Compute your rate of return if you sell the bond next year for $880.10. 7. Calculate the duration of a $1,000, 6% coupon bond with three years to maturity. Assume that all market interest rates are 7%. Expert Answer 100% (1 rating) 1. Present value of zero coupon bond = Face valu … View the full answer Previous question Next question

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price or value is the present value of all future cash flows expected from the bond. As the bond has no interest payments, the only cash flow is the face value of the bond received at the maturity date. Zero Coupon Bond Pricing Example. Suppose for example, the business issued 3 year, zero coupon bonds with a face value of 1,000.

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ...

What does it mean if a bond has a zero coupon rate? - Investopedia Zero Coupon Bonds A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to turn a profit. A bond...

Zero Coupon Bond: Formula & Examples - Study.com A zero-coupon bond still has 5 years to mature and is currently priced at $760 in the capital market. Assume that the face value is $1,000 and the required interest rate of the bond is 5%...

Investment Banking, Financial Modeling & Excel Blog Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Because a zero-coupon bond has only one cash flow which occurs at the time of maturity of the bond, its price/value equals the present value of that cash flow discounted at the required rate of return. The following formula can be used to work out value of a zero-coupon bond: Value of Zero-Coupon Bond =. Face Value.

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Mapping and VaR of Zero Coupon Bond - Course Hero Mapping Cash Flows of a Zero Coupon Bond This workbook shows how to map a zero-coupon bond and. Study Resources. Main Menu; by School; by Literature Title ... rate 0.01000% 0.00222% Impact of an 01 change in right-reference rate 0.00778% 0.01000% Bond Cash Flow Principal $1,000,000 Present value of total bond cashflow. Impact of 01 bp change on ...

Solved 1. Calculate the present value of a $1000 zero-coupon - Chegg Question: 1. Calculate the present value of a $1000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. 2. Consider a coupon bond that has a $1000 par value and a coupon rate of 10%. The bond is currently selling for $1150 and has eight years to maturity. What is the bond's yield to maturity? This problem has been solved!

› bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive...

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond Formula - Example #1. Let us take the example of some coupon paying bonds issued by DAC Ltd. One year back, the company had raised $50,000 by issuing 50,000 bonds worth $1,000 each. The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity.

› terms › pWhat Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

Post a Comment for "39 present value of a zero coupon bond"